AI Asset Management: Your Complete Strategy Transform Guide

Aarav Mehta • June 17, 2025

Master AI asset management with proven strategies that drive real results. Learn from industry experts using practical approaches to transform portfolios.

Demystifying AI Asset Management: What It Really Means For You

Imagine sitting down with a financial advisor who has read every market report, analyzed every trade, and spotted every emerging trend. That’s the potential of AI asset management. Let’s move past the buzz and explore what it truly offers.

AI asset management uses machine learning algorithms to analyze massive amounts of financial data. Think of these algorithms as tireless detectives, constantly searching for clues hidden within the market. They can uncover subtle patterns and opportunities that might take human analysts months to find. It's like having a superpowered research team working 24/7.

Understanding the Power of AI

The image below, from Wikipedia's page on Artificial Intelligence, gives you a glimpse into the field's broad scope:

This overview shows how AI connects with various fields. AI asset management is just one piece of a much larger puzzle. Grasping the core principles of AI is essential for understanding its potential in finance.

AI and Human Insight: A Powerful Partnership

One common misconception is that AI will replace human expertise. The reality is quite different. Think of AI as a powerful tool that enhances human judgment. Successful investors are blending AI with their own experience and knowledge. It’s like combining the precision of a surgeon's scalpel with the wisdom of a seasoned doctor.

This collaborative approach is proving incredibly effective. AI provides the speed and analytical power, while human investors bring strategic thinking and nuanced understanding.

The Rapid Growth of AI in Asset Management

The adoption of AI in asset management is accelerating at an incredible pace. Market analysts predict a compound annual growth rate (CAGR) of up to 26.92% between 2025 and 2032. You can find more details about this growth in this article: AI in Asset Management Trends.

This rapid expansion makes it clear: staying informed about AI's impact on asset management is no longer a luxury, but a necessity. Understanding AI’s capabilities is now crucial for navigating the future of finance.

The AI Asset Management Revolution: Why Everyone's Paying Attention

The financial world is drowning in data. Imagine trying to sip water from a firehose – that's what it's like for financial analysts today. Traditional asset management methods are struggling. They were built for a different time, a time of less data and simpler markets. This overwhelming amount of information, coupled with increasingly complex regulations, has opened the door for a new solution: AI asset management.

This isn't just a software update; it's a complete shift in how financial institutions work. Picture a tireless team of analysts processing information at speeds no human could ever match. That's the power of AI. It's not about replacing human intelligence; it's about enhancing it. This collaboration of human insight and AI is proving incredibly effective.

This transition has led to significant growth in the AI asset management sector. Big institutions are taking notice, investing billions in AI infrastructure. This investment is impacting the entire financial ecosystem, influencing everything from personal investment choices to worldwide market trends. Over the past decade, AI in asset management has exploded, evolving from a niche technology to a crucial element of global financial strategies. Industry research shows the market valued at USD 3.4 billion in 2024, projected to reach USD 21.7 billion by 2034, a CAGR of about 24.2%. Discover more insights about this impressive growth.

To better illustrate this market growth, take a look at the projections from a key industry source:

AI Asset Management Market Growth Projections

| Source | 2024 Value | Projected 2034 Value | CAGR |

|---|---|---|---|

| GlobeNewswire | USD 3.4B | USD 21.7B | 24.2% |

This table clearly demonstrates the expected growth in the AI asset management market, based on GlobeNewswire's data. This growth is driven by the increasing need for more efficient and intelligent solutions in the finance industry.

The Driving Forces Behind the Growth

Several factors contribute to this rapid expansion. The sheer volume of financial data is a key driver. Traditional methods simply can't handle the flood of information. AI, on the other hand, excels in these data-rich conditions, identifying patterns and insights humans might miss. The growing complexity of regulations is another significant factor. AI can assist institutions in meeting these requirements by automating compliance and providing more accurate risk assessments.

Impact on Investors and Career Opportunities

This growth isn't just impacting institutions; it's changing the game for individual investors too. AI-powered platforms are giving everyday investors access to sophisticated investment strategies. This democratization of finance empowers individuals to manage their investments with greater accuracy and control. The rise of AI is also creating new career opportunities in finance. The demand for professionals with AI skills is booming, opening up exciting new roles for those who combine financial expertise with technical abilities. You might be interested in: AI Stock Image Generator. This expansion marks a fundamental shift in the financial world, moving toward a more data-driven, automated, and intelligent approach to asset management.

Where AI Asset Management Makes The Biggest Difference

AI asset management is like having a tireless team of experts working for you 24/7. But where does this technology truly deliver? Let's explore the key areas where AI is making a real impact.

Portfolio Optimization: The Chess Master

Think of a chess master evaluating countless moves at once. That's what AI does for portfolio optimization. AI algorithms process massive amounts of data—market trends, economic indicators, and individual asset performance—to build the best possible portfolios. These AI-driven strategies adapt to changing market conditions far faster than a human, maximizing potential gains while managing risk.

Risk Assessment: The Early Warning System

Traditional risk assessment is often reactive, dealing with problems after they occur. AI shifts this to a predictive approach. AI systems can spot subtle signals in market data that human analysts might miss. This early warning system helps identify potential risks before they become major issues, allowing for timely adjustments to investment strategies.

Fraud Detection: The Powerful Safeguard

This screenshot from BlackRock's website highlights their focus on technology and innovation, hinting at how integrated AI likely is in their processes. Visuals like this underscore the growing role of technology in modern finance. Major players like BlackRock, Charles Schwab, and IBM are already using AI-powered platforms—such as Aladdin, Schwab Intelligent Portfolios, and IBM Watson—to automate trading, enhance client services, and improve efficiency. Learn more about AI in asset management.

Let's take a closer look at how different AI applications benefit asset management. The table below summarizes key applications, their functions, benefits, and implementation complexity.

AI Applications and Their Primary Benefits Overview of key AI applications in asset management and their specific advantages

| Application | Primary Function | Key Benefits | Implementation Complexity |

|---|---|---|---|

| Portfolio Optimization | Building and managing optimal investment portfolios | Maximized returns, reduced risk, faster adaptation to market changes | High |

| Risk Assessment | Identifying and evaluating potential investment risks | Early warning of potential problems, improved risk mitigation strategies | Medium |

| Fraud Detection | Detecting and preventing fraudulent activities | Reduced financial losses, enhanced security, protection of investor assets | High |

| Algorithmic Trading | Automating trade execution based on predefined rules | Faster trade execution, improved efficiency, reduced human error | High |

| Client Advisory Services | Providing personalized investment advice and financial planning | Improved client relationships, increased client satisfaction, tailored advice | Medium |

| Regulatory Compliance | Ensuring adherence to financial regulations | Automated reporting, reduced compliance risks, improved efficiency | Medium |

As this table demonstrates, AI offers powerful capabilities across a range of asset management functions. While implementation complexity can be high for some applications, the potential benefits are substantial.

Algorithmic Trading: The Speed Demon

AI fuels algorithmic trading, allowing high-frequency trading that executes trades with incredible speed. These algorithms respond to market shifts in milliseconds, seizing fleeting opportunities and optimizing execution. This level of speed and precision just isn't achievable with traditional methods.

Client Advisory Services: The Personal Touch

AI is also changing how client advisory services are delivered. By analyzing client data, AI systems can offer personalized investment recommendations and tailor financial plans to individual needs. This personalized approach helps advisors provide more targeted and valuable guidance.

Regulatory Compliance: The Rule Follower

Navigating complex financial regulations can be difficult. AI can help simplify regulatory compliance by automating reporting and flagging potential compliance issues. This helps firms stay compliant while freeing up human resources for other tasks. You might also be interested in: AI Marketing Software.

These are just a few examples of how AI is reshaping asset management. From optimizing portfolios to improving client service, AI offers a wealth of benefits that are changing finance. As AI continues to develop, we can expect even more innovative uses to appear, further cementing its role in the financial world.

Real Success Stories: AI Asset Management That Actually Works

Let's move from the theoretical to the practical. How are companies actually using AI asset management to get real results? These aren't just ideas, but real examples of AI tackling investment problems. We'll look at different ways it's being used, from small firms competing with giants to big institutions changing how they work with clients.

Schwab Intelligent Portfolios: Automated Investing Made Easy

Charles Schwab's Intelligent Portfolios platform is a great example of AI-driven asset management in action. It uses algorithms to build and manage diverse portfolios tailored to each investor's goals and how much risk they're comfortable with. This automated approach makes sophisticated investment management available to more people.

This screenshot shows how user-friendly the platform is, focusing on goal-based investing—a key feature powered by AI. It simplifies complex investment decisions, making managing portfolios easier for everyone.

BlackRock's Aladdin: The Engine of Institutional Investing

BlackRock's Aladdin platform shows the power of AI for large institutions. This complete investment management platform uses AI to analyze huge amounts of data, assess risk, and optimize portfolios for some of the world's biggest investors. Aladdin helps BlackRock and its clients navigate tricky markets and manage risk effectively. It's a powerful tool that shows how AI can handle the complexities of institutional investing.

Smaller Firms Gaining an Edge Through AI

AI isn't just for the big guys. Smaller investment firms are using it to gain a competitive edge. With AI-powered tools, they can analyze data more efficiently, find unique investment opportunities, and offer personalized service that rivals larger institutions. This shows how AI levels the playing field, enabling smaller firms to compete effectively.

Navigating the Challenges of Implementation

These successes weren't without their hurdles. Companies faced challenges like integrating data, meeting regulations, and training their teams. For instance, Charles Schwab had to ensure its Intelligent Portfolios platform met strict rules. BlackRock faced the complex task of integrating Aladdin with its clients' existing systems. These cases highlight the need for careful planning and execution for successful AI implementation.

Seeing Real Results and Tangible Benefits

These AI implementations produced real results. Charles Schwab saw more client engagement and better portfolio performance. BlackRock's Aladdin platform improved risk management and streamlined operations. Smaller firms experienced greater efficiency and happier clients. These examples show that AI asset management can deliver measurable outcomes and real benefits. By learning from these real-world experiences, companies can build their own AI strategies with more confidence and a clearer understanding of what's possible. The key takeaway: AI asset management isn't some far-off idea; it's a practical tool already changing the world of finance.

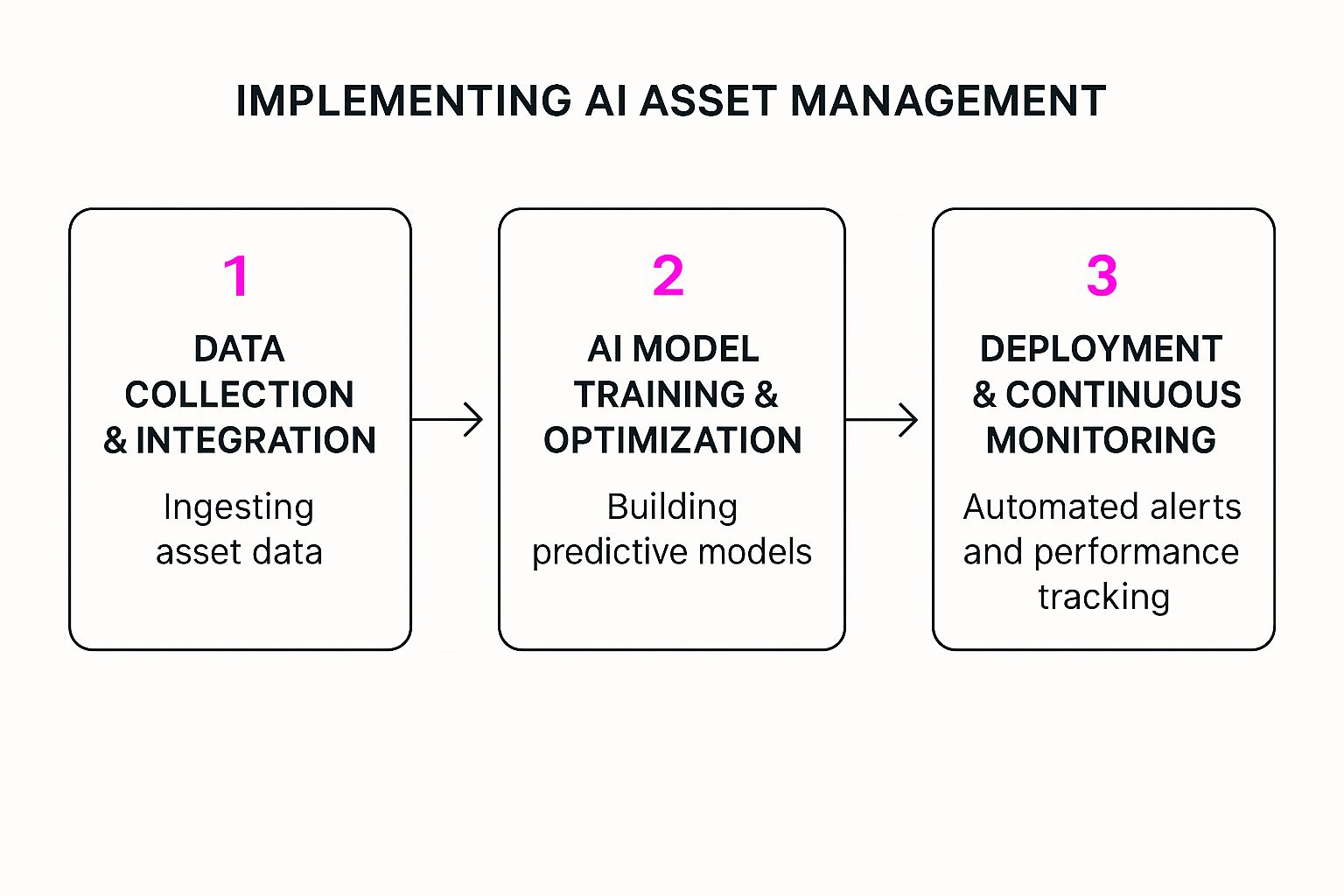

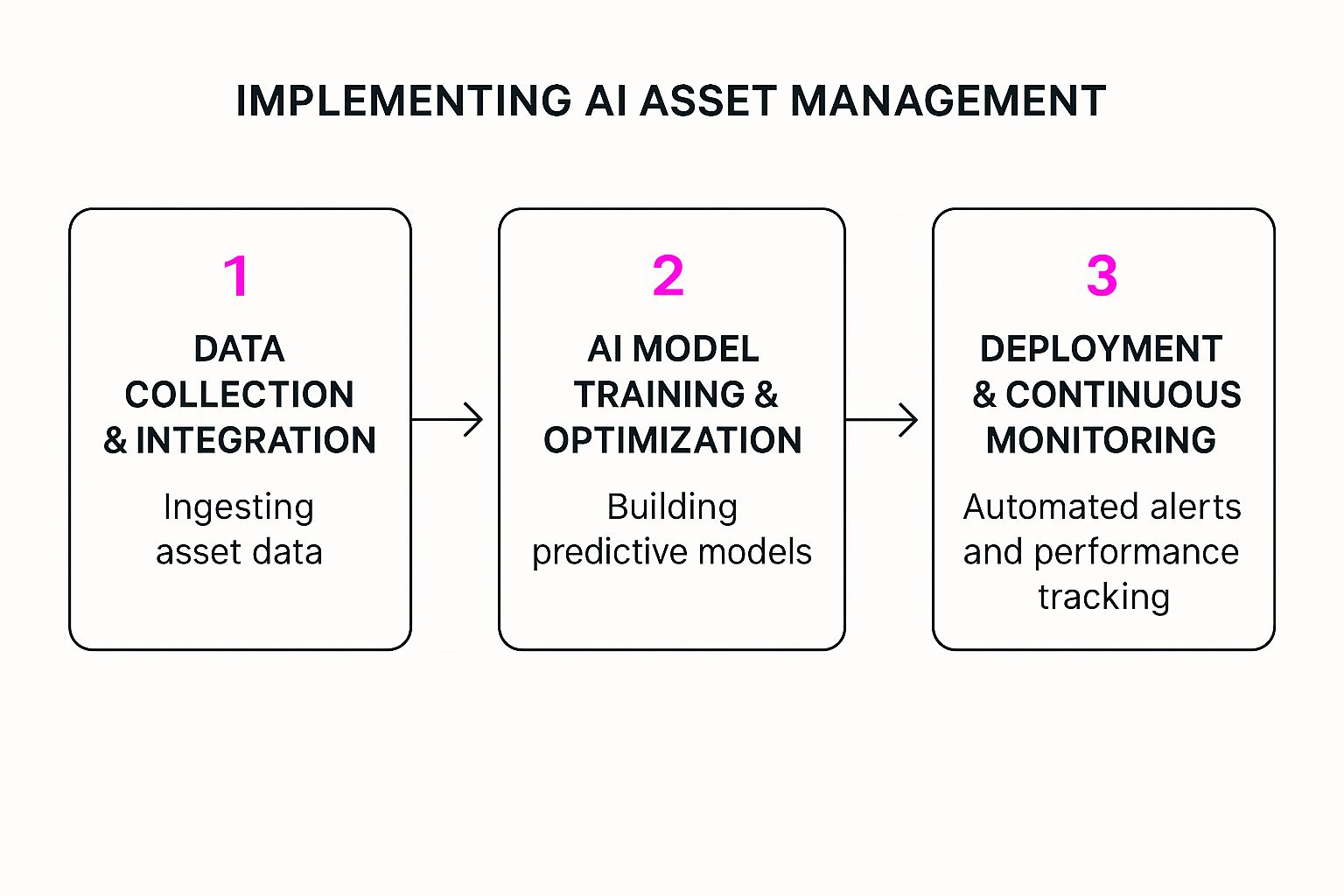

Your AI Asset Management Implementation Roadmap

Implementing AI asset management isn't like flipping a switch. It's more like building a house – you need a solid foundation before adding any fancy features. This section breaks down the implementation process into clear, actionable steps, making AI adoption less mysterious and more manageable.

Phase 1: Data Collection and Integration

Think of your data as the essential ingredients for a complex recipe. This phase is all about gathering those ingredients, cleaning them, and preparing them for your AI "chefs" (the algorithms). This might involve combining data from different sources, ensuring everything is in a consistent format, and fixing any quality issues. The quality of your data directly impacts how well your AI performs—garbage in, garbage out, as they say.

This initial groundwork is crucial. Just like a chef needs quality ingredients, your AI needs reliable data to deliver insightful results. Without it, the whole system won't function properly.

Phase 2: AI Model Training and Optimization

With your data foundation set, you can start training your AI models. This is where the real learning begins. Imagine teaching a student to recognize patterns and make predictions. It takes practice, feedback, and refinement.

Similarly, training your AI involves testing, tweaking, and optimizing to ensure it performs accurately and reliably. This includes choosing the right AI algorithms, fine-tuning their parameters, and validating their performance. The best model will depend on your specific goals and the type of asset data you're working with.

This iterative process is like coaching an athlete – constant practice and adjustments are key to achieving peak performance.

Phase 3: Deployment and Continuous Monitoring

Deploying your AI model is like launching a ship. It's a big step that needs careful planning and execution. This includes integrating the model into your existing systems, setting up monitoring tools, and training your team to use these new resources effectively.

After deployment, continuous monitoring is critical. Think of it like navigating a ship – you need to constantly adjust course to stay on track. Your AI model requires regular adjustments to maintain performance and adapt to changing market conditions. This ensures your AI continues delivering value over time.

This infographic illustrates the three phases: data preparation, model training, and deployment/monitoring. Each phase is vital and builds upon the previous one, creating a smooth and successful AI integration.

Choosing the Right AI Partner

Picking the right AI partner is like selecting a skilled guide for a challenging climb. You need someone with experience, expertise, and the ability to navigate unforeseen obstacles. Factors to consider include their knowledge of financial markets, the flexibility of their platform, and the level of support they offer. The right partner can make a world of difference in your AI journey.

This image from the IBM Watson website shows their AI solutions. The platform's capabilities extend beyond asset management, demonstrating AI's growing impact across various fields. Choosing a platform with a strong track record and robust support can be invaluable.

Measuring Your Success

Defining clear success metrics is like having a compass for your AI asset management journey. These metrics might include improved portfolio performance, lower risk exposure, or increased operational efficiency. Think of these metrics as your guideposts, helping you stay on track and achieve your AI goals.

By setting measurable targets and tracking your progress, you can show the value of your AI investment and identify areas for improvement. Regular review of your performance helps ensure your AI strategy aligns with your overall business goals and delivers real results. This data-driven approach helps you get the most out of AI in your asset management operations. By following this roadmap and continuously adapting your strategy, you can turn the complexity of AI into a source of real success.

Strategic Best Practices For AI Asset Management Success

Having the right AI tools is only half the battle. Think of it like having a top-of-the-line kitchen: it’s great, but you still need to know how to cook! True success in AI asset management comes from understanding how to strategically implement those tools within your organization.

Building a Foundation for Success

Organizational readiness is key. Imagine trying to build a house without a blueprint. Similarly, implementing AI effectively requires a solid foundation of understanding throughout your team. This means fostering AI literacy, ensuring everyone, from analysts to managers, understands AI's capabilities and limitations. Training programs can be invaluable here, helping bridge any knowledge gaps and empowering your teams to leverage AI effectively.

Establishing Clear Governance Frameworks

AI implementation isn’t the Wild West. Just like any powerful tool, it needs clear guidelines for use. Governance frameworks act as these guidelines, defining roles and responsibilities to ensure accountability and responsible AI usage. These frameworks should cover data security, ethical considerations, and compliance with relevant regulations. They’re like the safety protocols in a lab, protecting everyone involved and preventing unintended consequences.

Balancing Automation and Human Oversight

AI excels at automating repetitive tasks, but human oversight is still crucial. Think of it like an airplane’s autopilot: great for routine flight, but the pilot needs to be ready to take control in challenging situations. Similarly, AI should handle the tedious tasks, freeing up human analysts to focus on strategic decision-making and complex analysis. This partnership maximizes the strengths of both AI and human intelligence.

Maintaining Regulatory Compliance in an AI-Driven World

The regulatory landscape for AI is constantly evolving. It’s like navigating a ship through changing currents: you need to be aware of the shifts and adjust your course accordingly. Staying informed and adapting your strategies is essential. Your governance frameworks should be flexible enough to incorporate these regulatory changes, ensuring your AI asset management practices remain compliant and minimizing risk. You might find resources like AI Content Creation Tools helpful in staying up-to-date.

Building Adaptable Systems

Markets are dynamic, constantly shifting and changing. Your AI systems need to be able to adapt, just like a chameleon changes its color to blend in with its surroundings. This means building systems that can learn and adjust to changing market conditions. Continuous monitoring of AI performance and regular updates to algorithms and models are crucial for long-term success.

Managing Risk Effectively

Implementing AI comes with inherent risks. Think of it as climbing a mountain: there are potential dangers, but you can mitigate them with proper planning and equipment. Developing a robust risk management strategy is essential. This includes identifying potential pitfalls, implementing mitigation strategies, and establishing clear protocols for handling unexpected events. Stress testing your AI models, for example, can help you identify vulnerabilities and improve their resilience.

Monitoring Performance and Driving Continuous Improvement

Monitoring AI performance isn’t a one-time check-up; it’s an ongoing process. It's like regularly tuning a musical instrument to keep it playing its best. Tracking key metrics, such as portfolio performance, risk exposure, and operational efficiency, ensures your AI is delivering the expected results. Regular review of these metrics allows for continuous improvement and maximizes the value of your AI investment.

Managing Change Effectively

Implementing AI often involves significant organizational change. It’s like renovating a house: it can be disruptive in the short term, but the long-term benefits are worth it. A well-defined change management plan can smooth the transition. This includes clear communication, proactively addressing concerns, and providing adequate training and support. This approach minimizes resistance to change and creates a positive environment for AI adoption.

By following these best practices, organizations can navigate the complexities of AI asset management and realize its full potential, ensuring AI implementation is not just a costly experiment, but a driver of long-term success.

Your Next Steps In AI Asset Management

So, we've journeyed through the world of AI asset management. Now, it's time to chart your own course. Whether you're an individual investor just starting out with AI, a financial advisor looking to improve client services, or an institutional manager planning a major AI integration, what you do next matters.

Assessing Your Current Capabilities

First, take stock of what you already have. Think about your existing tech, your data setup, and the skills within your team. It's like planning a road trip—you need to know your starting point before mapping the route. This honest self-assessment will reveal your strengths and where you might need support, laying the groundwork for a solid AI strategy.

Defining Your AI Objectives

Now, think about your goals. What specific challenges are you hoping AI can help you solve? Perhaps you want to boost portfolio performance, improve your risk management, or make your operations more efficient. These objectives are your compass, guiding your AI journey and keeping your efforts focused.

Building Your AI Roadmap

Once you have clear objectives, you can create a step-by-step plan for implementing AI. This roadmap outlines everything from integrating your data and training the AI models to deploying the system and monitoring its performance. Think of it as the blueprint for your project, detailing the tasks, timelines, and resources you’ll need for a successful AI integration.

Choosing the Right AI Partner

Finding the right AI partner is a crucial step. Look for partners who understand financial markets inside and out, have a proven track record, and offer ongoing support. The right partner will be your guide, helping you navigate the complexities of AI implementation and ensuring you get the most from your investment.

Measuring Your AI Success

How will you know if your AI strategy is working? You need to define metrics to track your progress. These metrics should directly relate to the objectives you set earlier, providing measurable evidence of your AI's impact. Regular monitoring allows you to fine-tune your strategy, identify areas for improvement, and demonstrate the value you're getting from your AI investment.

Resources for Continued Learning

Your AI journey doesn't end here—it’s just the beginning. AI is constantly evolving, so ongoing learning is crucial. Explore online resources, connect with industry communities, and attend conferences to stay informed about the latest advancements in AI asset management.

Building Your AI Community

Networking with other professionals in the field is incredibly valuable. Sharing experiences, best practices, and lessons learned can accelerate your learning and help you avoid common mistakes. Look for online forums, industry groups, and networking events to expand your AI community.

Taking the Next Step With Bulk Image Generation

In asset management, clear communication and compelling visuals are key. Bulk Image Generation can quickly create high-quality images, charts, and infographics that bring your data to life. Explore how this AI-powered tool can enhance your workflows and communication.